Financial experts insist that they don't have a crystal ball, but they still have to predict the future anyway. That's why they watch a number of different economic indicators to determine the direction they expect different segments of the economy to head. For the owners of

Corona rental homes and their tenants, one of the most important segments is the one dealing with rents - will they continue to rise in 2012? If, as many experts predict, rents do continue on an upward path, it will mark the third straight year that they have done so. Corona landlords needn't ignore the trend.

Financial experts insist that they don't have a crystal ball, but they still have to predict the future anyway. That's why they watch a number of different economic indicators to determine the direction they expect different segments of the economy to head. For the owners of

Corona rental homes and their tenants, one of the most important segments is the one dealing with rents - will they continue to rise in 2012? If, as many experts predict, rents do continue on an upward path, it will mark the third straight year that they have done so. Corona landlords needn't ignore the trend.While the year is still too young to have established many economic indicators, here are some to watch for to help you make your own prediction regarding rent price trends that may affect your own decision-making:

- A quiet market in home purchasing. Americans remain anxious about the overall economy and have thus far refused to signal a clear end to the doldrums in home sales. Many Americans tend to remain in rental homes as they await clearer signals of a more robust economic recovery.

- Continuing high foreclosure rates have the effect of forcing homeowners out of their homes and into the rental home market. This decreases vacancy rates, raises demand -- and therefore, rents.

- Job growth fuels housing demand. As the population increases, at least some job growth is required to meet the resulting demand for goods and services - especially if growth in the supply of rental homes lags or remains flat.

- Rental unit construction starts were up 33.3% in the third quarter of 2011. Although such projects take time to reach completion, when they hit the market they will add to the supply of available rental homes -- and that absorbs some of the demand.

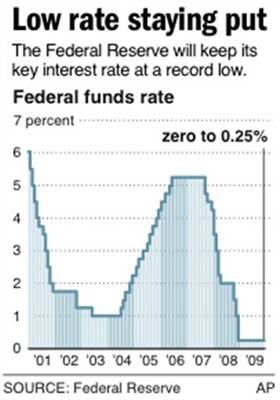

- Low mortgage rates make it more financially feasible to own rather than to rent. When rents have been rising for as long as they have, there is a growing likelihood that home sales will eventual rebound. When? That's where the crystal ball would come in handy!

The big question is, if rental home rates do continue to rise in 2012, how much can owners and renters expect? While the majority of analysts agree that residential rents should continue to rise, they vary when asked how much - from 2.5% to 5.5%, depending on which one you ask.

What are your thoughts? How many of you are holding off purchasing due to uncertainty in the marketplace? Or, have you gotten to the point where you are considering buying with Rent going up? Feel free to share.

Comments

Post a Comment