| |

October 2012 Market Update

The national housing market continues to recover, indicated by consistent increases in both home sales and prices. Inventories in much of the United States are primarily balanced, which favors neither sellers nor buyers. However, large pockets of the country are experiencing inventory shortages, which puts pressure on prices. Many of the hardest-hit areas during the downturn now have some of the tightest inventories. The return of price appreciation and a stronger market, particularly in those locations, is a welcome signal of returning market health.

“Some buyers are frustrated with mortgage availability. If most of the financially qualified buyers could obtain financing, sales would be about 10 to 15% stronger, and the related economic activity would create several hundred thousand jobs over the period of a year,” states NAR President Moe Veissi.

Despite difficult mortgage qualifying conditions sidelining some buyers, others are still taking advantage of excellent housing affordability conditions, which is evidence of notable stored-up housing demand that accumulated since 2007. With the housing market coming close to a full recovery and mortgage rates hitting new record lows, the time to buy is now.

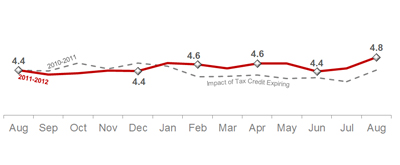

Home Sales

In Millions

Home sales this month rose 7.8% from last month to a seasonally adjusted rate of 4.82 million units, a 9.3% increase from last year. Distressed homes (which include short sales and foreclosures that traditionally sell for 15%–20% less on average compared to nondistressed homes) accounted for 22% of August sales, down from 25% of sales last month and 31% of sales last year. Although the amount of distressed properties is decreasing from month to month, they are still high by historic standards.

.

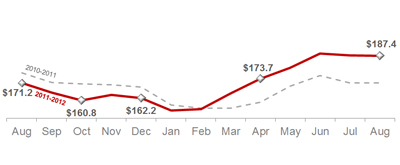

Home Price

In Thousands

Home prices continue to rise due to shrinking inventory and an increase in demand. The current median home price is $187,400, up 9.5% from a year ago and down just 0.2% from last month. This has been the sixth consecutive month of year-over-year price gains, the largest year-to-date rise since 2005.

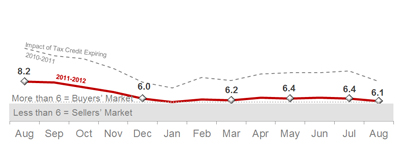

Inventory- Month's Supply

In Months

Housing inventory rose to 2.47 million homes available for sale—a 6.1-month supply—up 2.9% from last month and down 18.2% from last year’s 8.2-month supply. This marks the ninth consecutive month of inventory at a 6-month supply, a clear indicator of a balanced market and full-scale housing market recovery. Robust improvement in employment is the primary concern remaining, and as that improves the housing market recovery will be on firmer footing for the future.

Source: National Association of Realtors

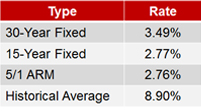

Interest Rates

Mortgage rates this month at or around 3.49% are back at record lows. The decline in the 30-year fixed rates is partially due to a result of the Federal Reserve’s announcement of “QE3.” QE3 is a new bond purchase plan which should help stimulate the ongoing housing recovery. Home buyer affordability remains high for home buyers who buy now while rates are low.

This Month's Video

| |

Brought to you by KW Research. For additional graphs and details, please see the This Month in Real Estate PowerPoint Report. The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed in This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate.

| |

Comments

Post a Comment